Reshoring

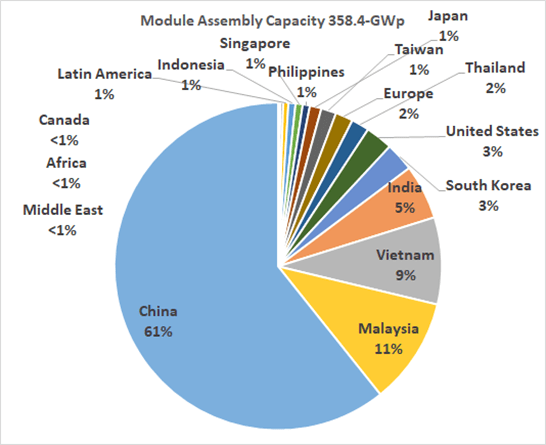

The US and India have implemented incentives to encourage domestic solar manufacturing. The EU and European countries have less defined plans but well-defined intentions for domestic solar manufacturing. With all the hoped for new solar manufacturing capacity in Europe, India, and the US, most seem to have forgotten that China makes most of the necessary manufacturing equipment. So, add that to the list of businesses needed to restart manufacturing outside of China.

How easy will it be for the US, India, Japan, and European countries to restart domestic manufacturing? Despite enthusiastic estimates of fast-growing supply chains, the start is slow, and for good reasons.

But before getting to the pros and cons of reshoring solar manufacturing – a word about Just in Time manufacturing. Also known as the Toyota Production System, JIT is a system of keeping inventory levels low by having suppliers align their production and delivery to customer orders. JIT worked well in theory and fact for decades – not seamlessly, of course. JIT works less well for smaller companies providing customized products. Changes in buyer tastes and the economy can lead to problems. As blatantly clear during the pandemic, a disruption to the distribution chain causes a complete collapse of JIT and a negation of the system’s positive aspects. JIT works less well for lopsided industries such as solar with one large supplier (China) and buyers outside China. During the pandemic, distributors, dealers, developers, installers, and module assemblers in the US, Europe, Japan, and other countries suffered long delays or were unable to get product at all.

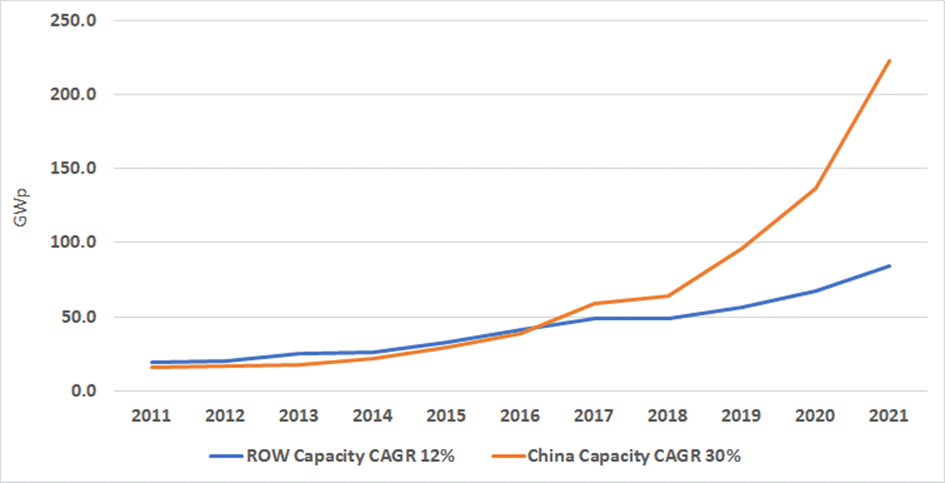

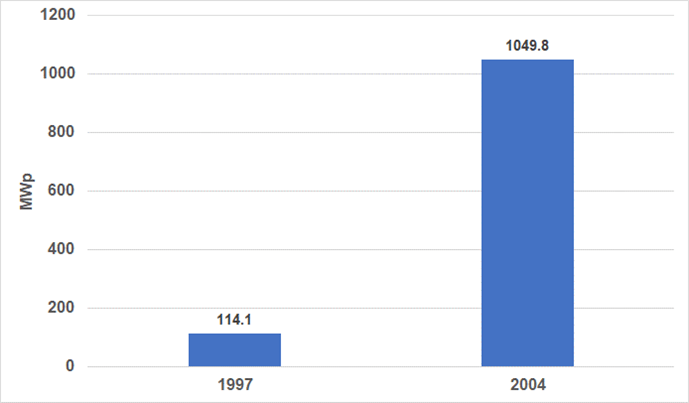

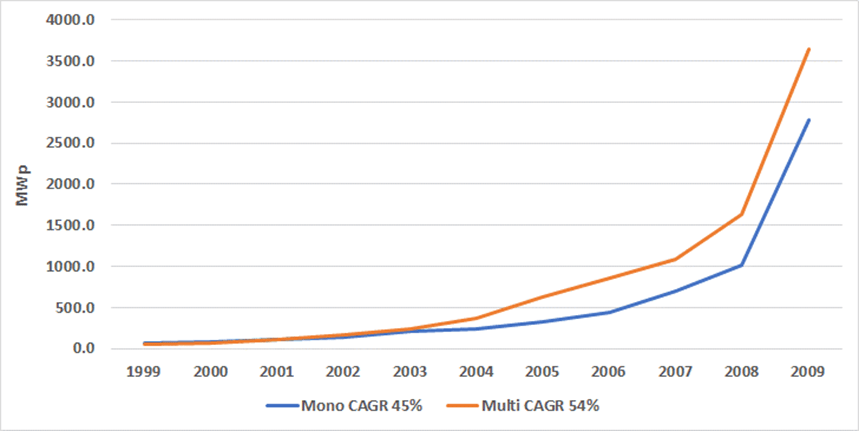

Though many in the solar industry do not remember a time when China did not dominate the supply chain, Europe, the US, South Korea, and Japan had thriving solar value chains over a decade ago. At least they did before aggressive pricing drove manufacturers in these countries out of business. Even South Korea’s manufacturers have struggled, with LG exiting in 2021.

Challenges to restarting domestic solar manufacturing in Europe, the US, and India include:

The expense and chicken and egg aspects of building a solar supply chain that needs (just for crystalline) metallurgical silicon, polysilicon, crystal growing, ingot pulling, wafer slicing, cell production, and module assembly – not to mention consumables such as adhesives, backsheets, glass, aluminum, and equipment. Where do you start? What do you build first? Adding cell manufacturing without the rest of the upstream value chain doesn’t get you there and adding polysilicon without sufficient metallurgical silicon or crystal growing, ingot pulling, and wafer slicing leaves a hole in the value chain. Some have suggested sending polysilicon from the US to China for processing – a solution that keeps the US an importer with many of the same supply chain problems it has now.

The uncertainty of demand for solar deployment during high inflation and a potential recession is a concern. Future demand is never a certainty. Face it, today’s forecast of exponential growth often becomes tomorrow’s explanation of why it was unmet. Current global economic and political stability may slow demand if inadequate infrastructure doesn’t do it first. That’s right, folks; no country has infrastructure capable of supporting current forecasts of solar demand – at least without sufficient storage.

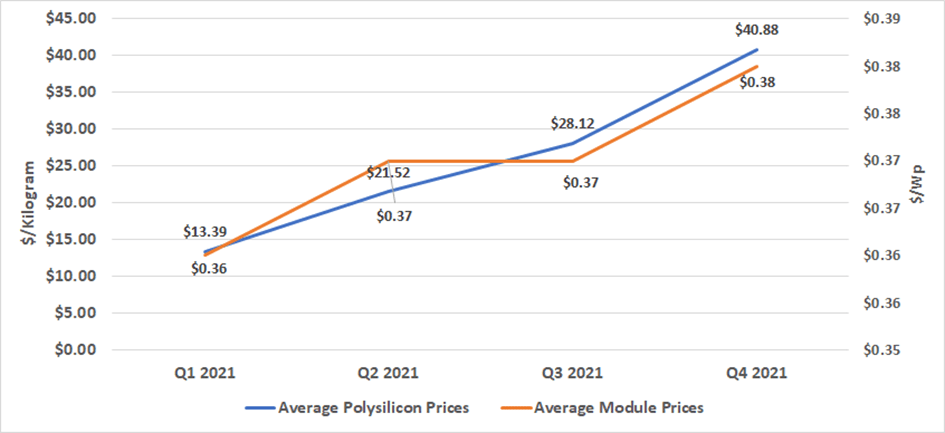

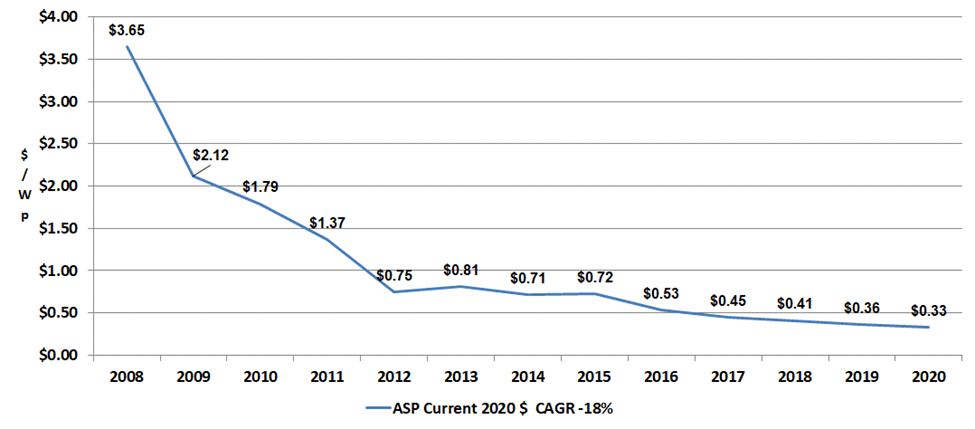

Developers worldwide (particularly in the US are clamoring for stable contracts, even at higher prices – they may not be satisfied for long, paying up to $0.10/Wp more than they did just five years ago. One reason for higher prices will be labor costs. Workers in Europe and the US demand and deserve a living wage. In India, a living wage means something different, and with less stringent labor laws, modules produced in the country will be less expensive. Elsewhere, again, in the US and Europe, wages typically increase, and employers must cover medical, potentially dental, insurance, and other costs and taxes.

On a positive note, with a domestic solar value chain, JIT principles should provide some inventory relief to manufacturers and help lower costs.

The solar industry will be healthier with diversified manufacturing – but it will not be easy to maintain. Cheap imports killed manufacturing in the US, India, Europe, and Japan once, and it can happen again, which means that high tariffs for imports will likely stay in place in the US and India. European countries may also need to implement higher import duties to protect their investment in domestic industry alive.

Infrastructure

Infrastructure is the elephant (or electron) in the room. Globally, infrastructure is insufficient to support renewable goals and forecasts. Also, goals and forecasts are fine and dandy, but without consistent government support, business models that address buying habits and affordability, and, oh yes, affordability, they are parsley.

California provides a prime example of enthusiastic goals and mandates that ignore hard realities. Solar is required on new buildings, and the state will phase out gas-only cars by 2035. Higher gas prices in the state are driving a boom in EVs. Yet, as the state enthusiastically embraces its electric car and renewable future, it has failed to develop the infrastructure and utility business model to support it.

The point is that goals are great, but the basics must come first. Unfortunately, infrastructure needs are often ignored until a crisis brings them to the fore. Even now, Texas is warning its citizens of rolling blackouts ahead of freezing weather. Texas experienced catastrophic infrastructure failure during its 2021 freeze – yet it failed to address the problem.

Perovskites

Not to knock perovskite technology – but a little common sense in the face of current enthusiasm is wise. Plenty of perovskite announcements these days; the PR-driven solar news is filled with announcements of record efficiencies, reliability improvements, benefits of roll-to-roll manufacturing, and for the US – the potential of polysilicon-free domestic manufacturing. Thus far, there is no evidence of improved reliability has emerged.

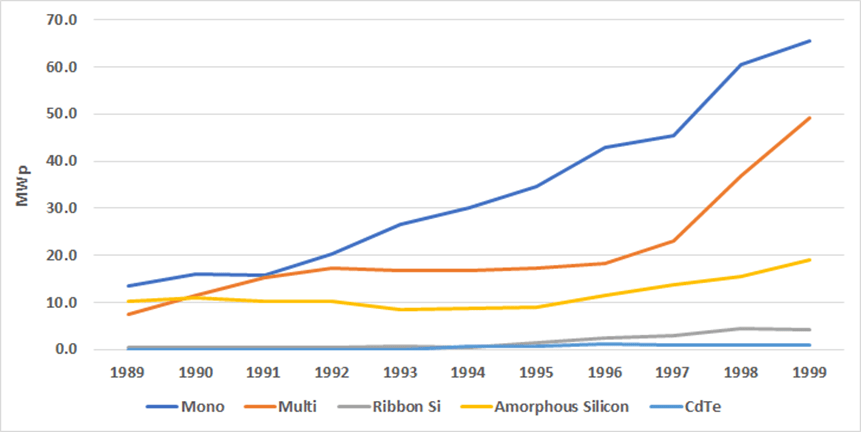

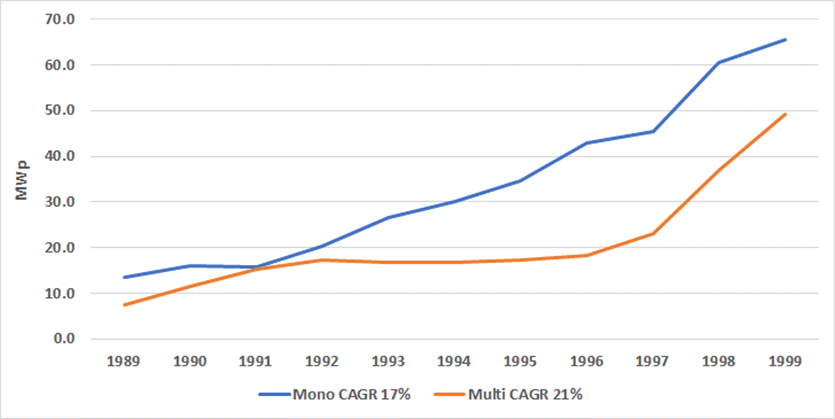

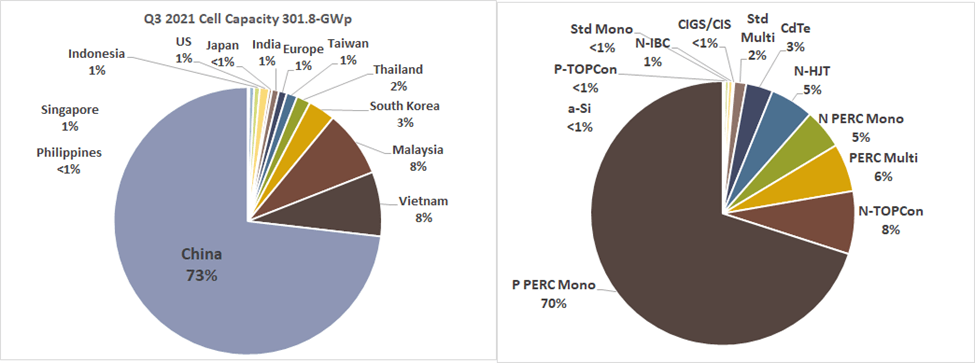

Right now, it’s a crystalline world – specifically, it’s a monocrystalline world likely split between p-and-n-type technologies. But don’t count multicrystalline out yet. Manufacturers continue to work on increasing multicrystalline efficiency using black silicon and n-type starting material. Meantime, monocrystalline producers are looking at p-type TOPCon and HJT to lower costs.